After a decade and a half of easy money, banks were unprepared for a return to interest rate normalcy

By Julio Gonzalez, Fox Business, April 7, 2023

All of our current economic ills can be traced back to one root cause: reckless overspending by the federal government.

The Federal Reserve just announced yet another rate hike, tapping the brakes on our economy once more as part of its ongoing battle against inflation. In truth, the central bankers probably would have preferred to raise rates by more than 25 basis points, but felt compelled to slow the rate of increase in response to recent fears of a financial crisis spurred by the high-profile failures of Silicon Valley Bank in California and Signature Bank in New York.

When the Fed first started hiking rates – and for quite some time after – Fed Chair Jerome Powell and other government officials spoke optimistically about a “soft landing.” This fantasy scenario would have involved taming inflation without triggering a recession or a significant uptick in joblessness.

But interest rates are a blunt tool. They are capable of taming inflation, but only to the extent that they inflict economic hardship to offset the artificial boost that gave rise to inflation in the first place. Higher interest rates make borrowing more expensive, reducing business investment and deterring consumer purchases of big-ticket items like cars and homes.

In this case (as it often is) the original culprit responsible for high inflation was profligate government spending in the form of multitrillion-dollar spending bills sold as “COVID relief” and “infrastructure.”

Put simply, the federal government flooded the economy with money, and it spread the wealth widely through a combination of direct payments to individuals and new contracts for public works projects. But it did this at the worst possible time – lingering supply chain bottlenecks created by COVID lockdowns meant there was too much money chasing too few goods. As any student of elementary economics can tell you, too much demand and too little supply means prices have to go up, and that’s exactly what happened.

Naturally, this has put a strain on household budgets. For almost two full years now, prices have been rising faster than wages, causing hard-working Americans to fall further and further behind, despite a relatively healthy labor market.

FEDERAL RESERVE OUT OF CONTROL: AMERICAN’S SHOULDN’T HAVE TO PAY FOR WALL ST-WASHINGTON MISTAKES

In response to rising inflation, the Fed started raising interest rates, which had been at near-zero from December 2008 to December 2015, and then again from March 2020 to March 2022. Although rates went up slightly in between those periods, they only reached a maximum of 2.25-2.5%, which is historically low. Today, for comparison, the Fed’s target rate is between 4.75% and 5%.

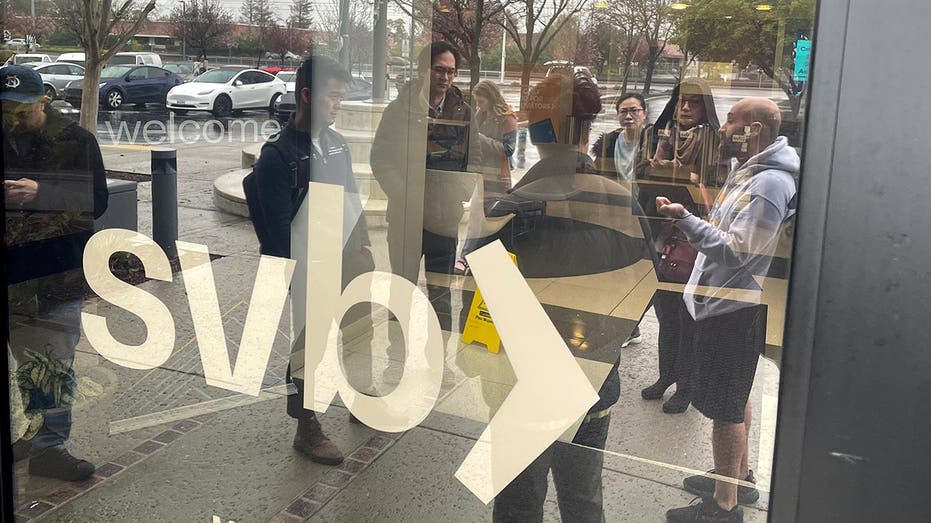

After a decade and a half of extremely easy money, banks were unprepared for a return to interest rate normalcy. Silicon Valley Bank, for instance, was heavily invested in Treasury bonds that it had purchased prior to the Fed’s recent spree of interest rate hikes. Those bonds, purchased at extremely low interest rates, became money-losers when inflation began to exceed their face value.

SVB’s predicament is not unusual, although it’s not typically fatal. The bigger problem is that SVB’s collapse sapped confidence in the banking system – and confidence is the key component undergirding the entire financial system.

In the long run, banks will adjust to higher interest rates. In the short term, however, there are likely to be additional dislocations that further jar the economy. Any hope of a “soft landing” has now been thoroughly dashed.

The trouble is, we still don’t know how all this will play out. Recession is now increasingly likely, and with it we can expect a downturn in the labor market – which means higher unemployment and slower wage growth.

We’re in a lose-lose situation, and it’s a direct result of excessive government spending that was, ironically, intended to improve the health of the economy.

Julio Gonzalez is the CEO and founder of Engineered Tax Services Inc.